take home pay calculator manitoba

The amount can be hourly daily weekly monthly or even annual earnings. Were making it easier for you to process your payroll and give your employees a great experience with their payslips.

You can quickly calculate your net salary or take-home pay using the calculator above.

. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual. A total of 24 Michigan cities charge their own local income taxes on top of. Take Home Pay Calculator by Walter Harder Associates.

Michigan is a flat-tax state that levies a state income tax of 425. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Hourly rates weekly pay and bonuses are also catered for.

The latest budget information from April 2022 is used to show you exactly what you need to know. For homes valued over 1 million a flat 20 minimum down payment is. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Just enter your annual pre-tax salary. For homes valued less than 1 million minimum down payments are 5 of the first 500000 then 10 of any value between 500000 and 1 million. Single SpouseEligible dep Spouse 1 Child Spouse 2 Children Spouse 3 Children.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. You can use the calculator to compare your salaries between 2017 and 2022. Personal Income Tax Calculator - 2021 Select Province.

Use the button to clear the personal information in order to start again. This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany. Why not find your dream salary too.

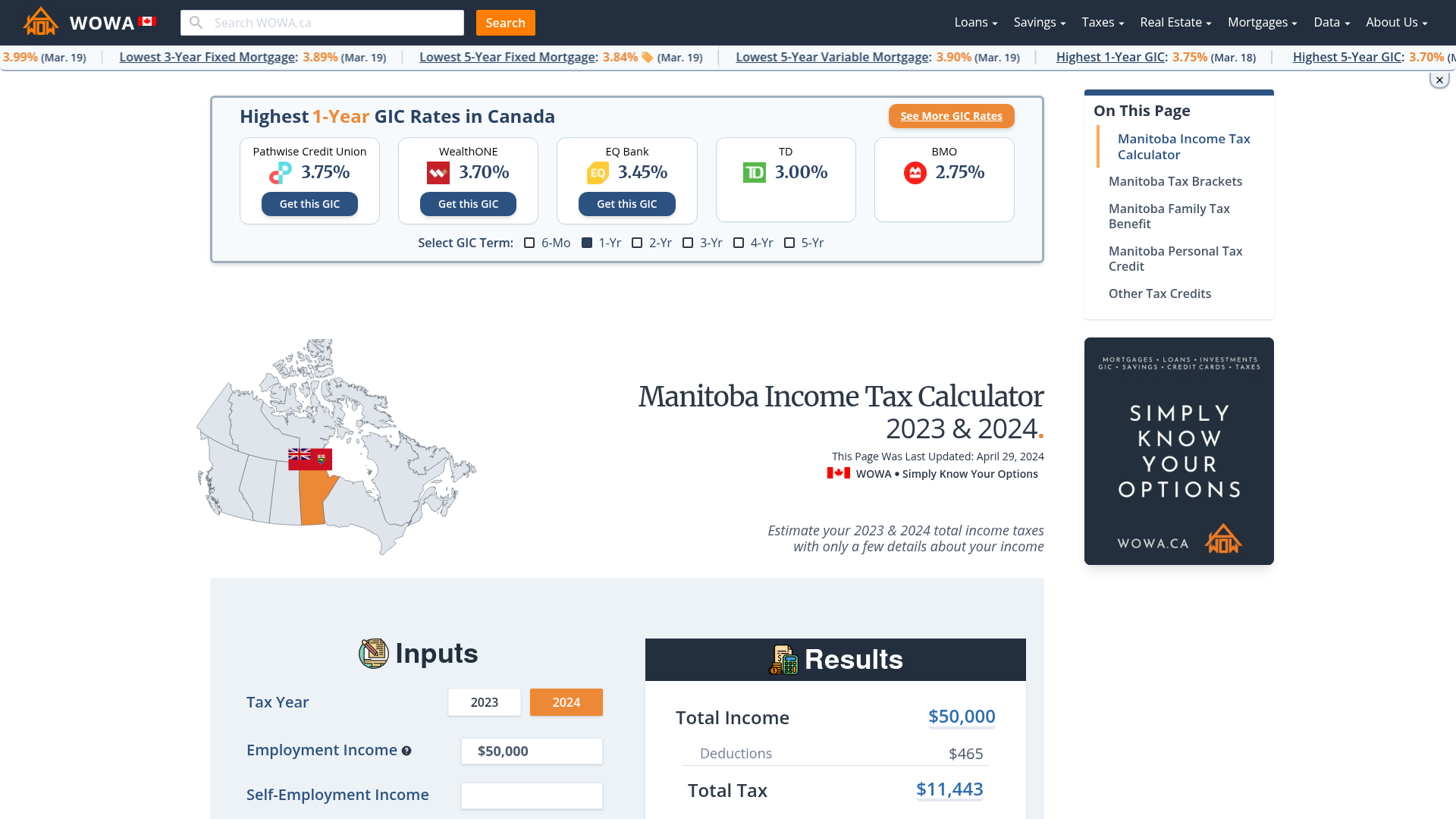

How to use a Payroll Online Deductions Calculator. If you make 52000 a year living in the region of Manitoba Canada you will be taxed 16332. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Enter your pay rate. The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month. To calculate your estimated annual take home pay see our online canadian tax calculator which is available for all provinces and territories except quebec which has its own calculator.

It can also be used to help fill steps 3 and 4 of a W-4 form. The calculator is updated with the tax rates of all Canadian provinces and territories. Personal Income Tax Calculator - 2020 Select Province.

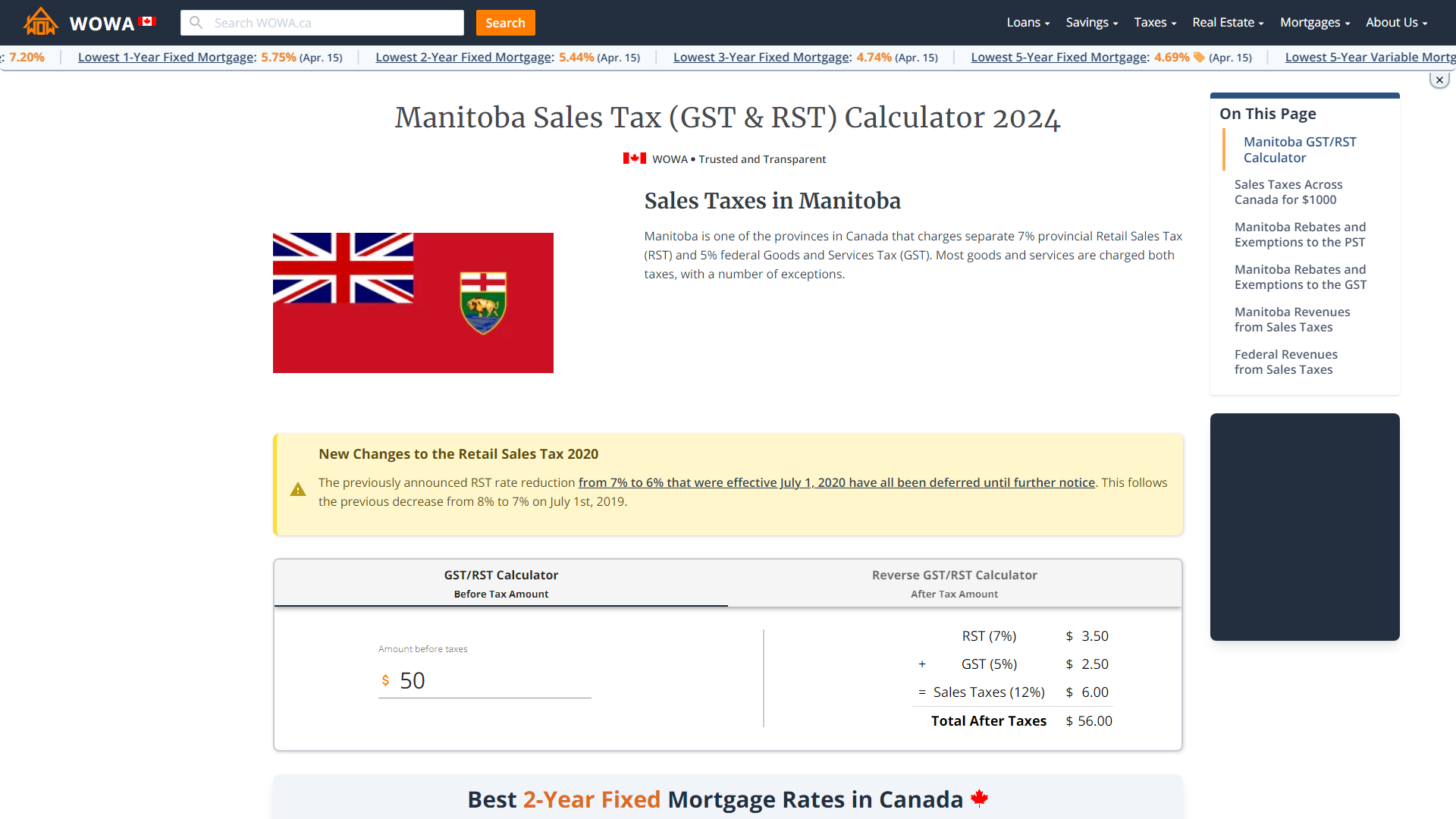

The state tax year is also 12 months but it differs from state to state. Ratehubcas Manitoba mortgage calculator automatically uses the following guidelines in its calculations. This marginal tax rate means that your immediate additional income will be taxed at this rate.

You assume the risks associated with using this calculator. The lowest tax rate in Manitoba is 108 for individuals who earn 34431 or less in one year. Some states follow the federal tax year some states start on July 01 and end on Jun 30.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Salary commission or pension. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major.

This calculator is intended for use by US. The tool then asks you to enter the employees province of residence and pay frequency weekly biweekly monthly etc. Target Take Home Pay.

It will confirm the deductions you include on your official statement of earnings. So you pay taxes at a 1080 tax rate on the first. Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open developer program.

That means that your net pay will be 35668 per year or 2972 per month. This marginal tax rate means that your immediate additional income will be taxed at this rate. Your average tax rate is 314 and your marginal tax rate is 384.

This tool will estimate both your take-home pay and income taxes paid per year month and day. Salary calculations include gross annual income tax deductible elements such as child care alimony and include. British Columbia Alberta Saskatchewan Manitoba Ontario New Brunswick Nova Scotia Prince Edward Island Newfoundland Yukon Northwest Territories Nunavut.

Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon. You first need to enter basic information about the type of payments you make. The reliability of the calculations produced depends on the.

Overview of Michigan Taxes. If you would like to know the required gross income for a specific annual take home pay amount enter the target take home pay here and the calculator will determine the gross pay required to generate that take home pay. Manitoba NB Manitoba Saskatchewan NS.

Back to Top. Your average tax rate is 220 and your marginal tax rate is 353. Enter the number of hours worked a week.

That means that your net pay will be 40568 per year or 3381 per month. If you earn more than 34431 but less than 74416 your income above 34431 will be taxed at 1275. In Canada income tax is usually deducted from the gross monthly salary at source through a pay-as-you.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Similar to the tax year federal income tax rates are different from each state.

About the 2021 manitoba salary calculator. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Finally the payroll calculator requires you to input your.

![]()

11 95 An Hour After Taxes In Manitoba In 2022

Pin On Winnipeg Manitoba Etsy Shops Sellers

2022 Manitoba Tax Calculator Ca Icalculator

Holiday Baskets Pattern Uncut Simplicity 8658

These Are The Best Manitoba Real Estate Agents On Social Media Check Out The Full List Of Top Agents Real Estate Agent Real Estate Estates

Retirement Savings Spreadsheet Excel Templates Spreadsheet Template Budget Spreadsheet

Manitoba Income Tax Calculator Wowa Ca

Net Income Tax Calculator Manitoba Canada 2020

Manitoba Salary After Tax Calculator World Salaries

How Much Does Central Air Conditioning Cost Central Air Conditioning System Central Air Conditioning Cost Air Conditioning Companies

Manitoba Salary After Tax Calculator World Salaries

Bathroom Remodel Cost Calculator Excel Remodels Document Cost Of Kitchen Cabinets Bathroom Remodel Cost Financial Calculator

2013 Badger Mn Minnesota Usgs Topographic Map 18in X 24in

Manitoba Sales Tax Gst Rst Calculator 2022 Wowa Ca

Manitoba Salary After Tax Calculator World Salaries

Software Engineers The Most Demanded Skilled Workers In Canada Software Engineer Engineering Careers Skills

Pin By Floor Decor Design Center On Luxury Vinyl Tile Luxury Vinyl Tile Flooring Luxury Vinyl Flooring